Save for your first home using super

The First Home Super Saver (FHSS) scheme was launched by the government to help Australians save for their first home using their super.

In this scheme, you can contribute up to $50,000 to your super account. You can save up to $15,000 per financial year and $50,000 in total.

When you are ready to purchase, if you meet the eligibility requirements, you can withdraw up to $50,000 in contributions plus associated earnings, less any tax.

The scheme can be used to purchase new or existing homes in Australia. Individuals can access their own FHSS scheme contributions as a couple, friends, or siblings to purchase the same home.

For eligibility requirements, read the ATO website.

Some potential benefits of saving for a home inside super

Super gets special tax treatment. You generally only pay 15% tax on earnings within super.

When you compare this to saving the same amount of money in a savings account, you have to pay tax on the interest earned in the savings account at your personal income tax rate (which increases as your salary does and can be as high as 47%).

How to use the FHSS scheme

1. Make personal contributions to your super account

Contributions must be voluntary either made by you or via salary sacrificing. You cannot access employer contributions through this scheme. Read more about personal contributions.

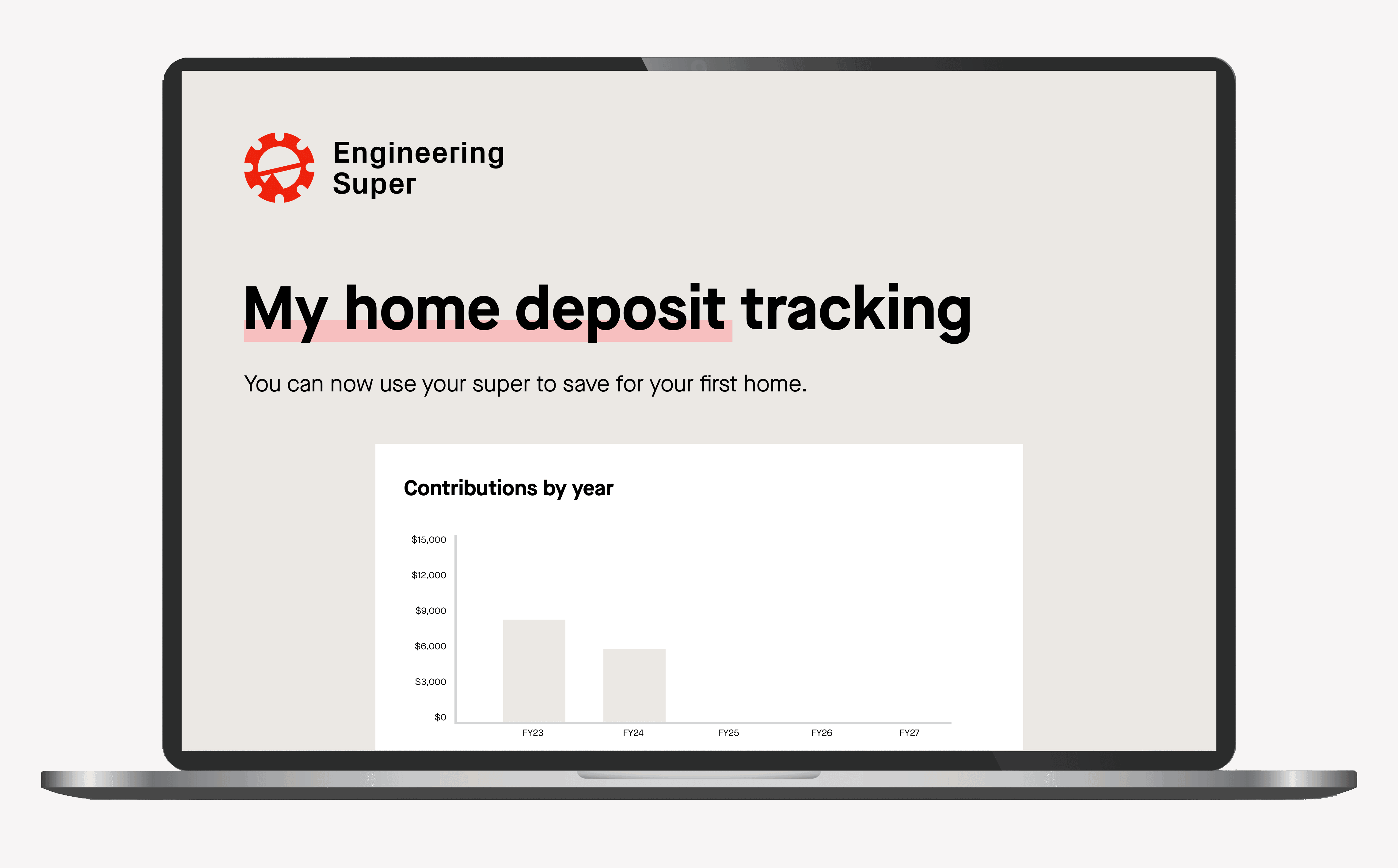

2. Keep track of your contributions

The First home deposit tracker will help you keep track of your voluntary contributions.

3. Access your savings

When you are ready to access your savings for your home deposit, you can apply with the ATO or via your myGov account to request a FHSS determination.

It’s important to consider the application processing time and release of the funds when applying for the FHSS determination and purchasing your home. The ATO website has more information.

Track your progress

We have created a simple tracking widget that monitors your personal contributions, so you know when you are approaching annual and total caps set under the First Home Super Saver Scheme.